Globally, we are seeing a rise in collective consciousness around the impact of Environmental, Social and Governance (ESG) issues on people, countries, businesses and economies.

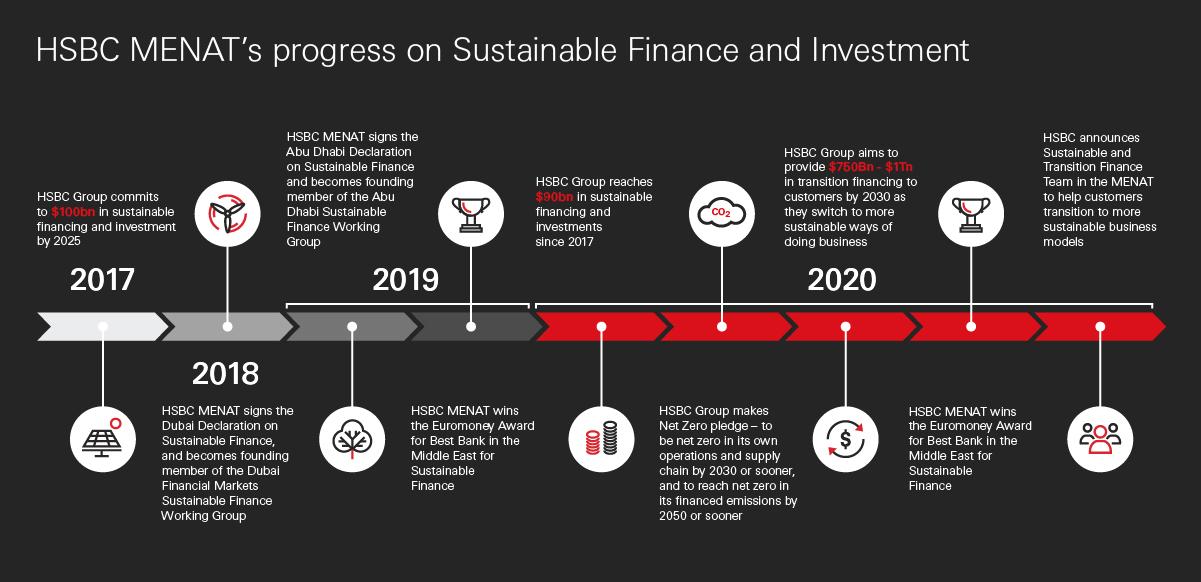

To help preserve the environment for future generations by supporting the transition to a low-carbon world, our strategy at HSBC is to equip people with the employability and financial capability skills they need today and in the future. We work in partnership with businesses to help serve the needs of a changing world and we are committed to doing our part to build a sustainable future.