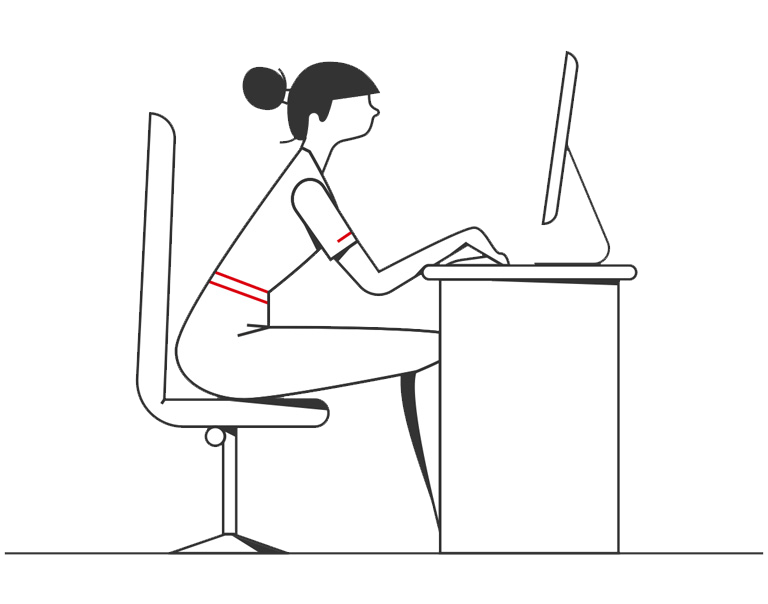

Browse a selection of products you may be interested in, or search for a specific product by type.

1 of 5 product themes

Collection library

Browse our collections of leading-edge products and problem-busting solutions. Each collection tackles a specific business aim; all of them you to thrive.

Need help?

Get in touch to learn more about our banking solutions and how we can help you drive your business forward.